Keep simple loans simple.

Compete against today’s fastest ‘non-banks’ with Fast Track, a purpose-built home equity lending solution that delivers funds to borrowers in under a week.*

A Broken Process Costs You Growth

Home equity lending is slowed by outdated, mortgage-style workflows that frustrate borrowers and burden lenders. Clunky applications drive high drop-off, slow decisioning stalls pull-through, and manual processes drag out cycle times.

The result: missed opportunities, inefficiency, and a competitive disadvantage.

Disconnected experiences lose borrowers.

Clunky applications and poor collaboration create borrower friction early in the process, leaving lenders with missed opportunities.

Borrower Engage

Borrowers move quickly to a conditional offer in minutes, with a streamlined application and embedded collaboration that keep them engaged throughout the process.

Slow, complex processes and technology stall your growth.

Mortgage-style processes and antiquated technology slow home equity lending, creating unnecessary complexity and delays.

Lender Intelligence

Simplify and accelerate loan approvals with our decision guidance engine, making simple loans fast and compliant.

Manual handoffs drag out funding.

Even after a quick clear-to-close, a broken closing & funding process with manual steps and clunky technology grinds the loan to a halt.

Quick Close

Streamline the final stages of the lending cycle and give lenders the platform they need to close & fund in under a week.*

See Fast Track in Action

Take a guided tour of how Borrower Engage, Lender Intelligence, and Quick Close work together to streamline home equity lending from application to funding.

See Fast Track in Action

Take a guided tour of how Borrower Engage, Lender Intelligence, and Quick Close work together to streamline home equity lending from application to funding.

Borrower Engage

Seamless borrower experience

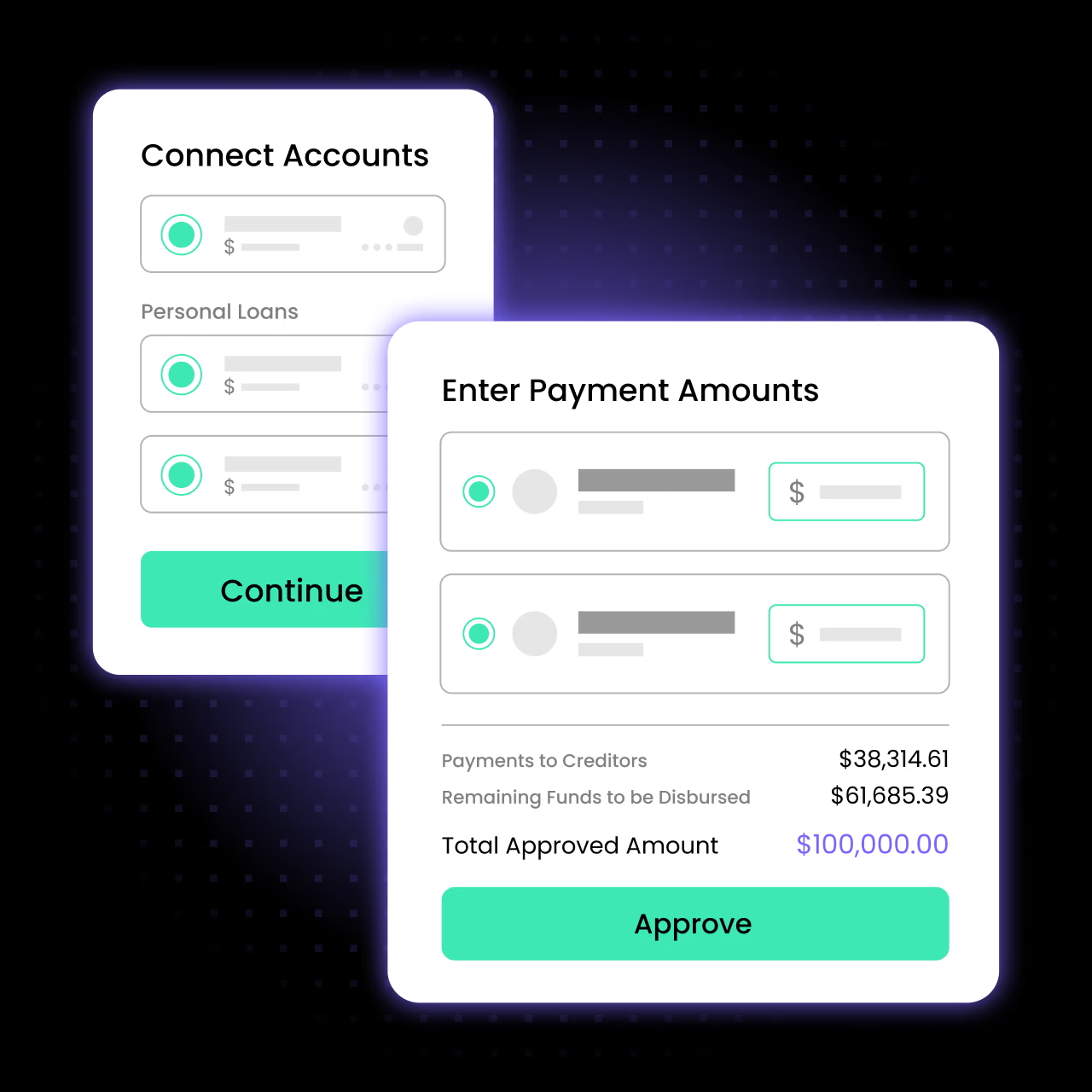

Lender Intelligence

Smarter loan decisioning

Quick Close

Faster funding

Faster Lending, Better Outcomes

Hear how Coviance helps lenders grow revenue, efficiency, and borrower satisfaction.

Return On Investment

Turn more applications into funded loans. Fast Track delivers faster closings and measurable growth without adding complexity or changing your policy.

Fuel Your Growth with a Health Check

Are inefficiencies holding back your lending? Our Home Equity Health Check evaluates your program with data driven insights, benchmarks, and practical steps to accelerate growth.

Request your Home Equity Health Check

*"Funds to borrowers in under a week” and "Clear-to-Close in 48 hours" assumes the utilization of Fast Track automation, the loan progresses through all of the automation, and prompt cooperation by Applicant(s). Timeline excludes delays caused by Applicant(s), traditional valuations, or any solutions which require manual intervention.