Approvals in Hours.

Funding in Days.

From application to funding, Coviance gives community lenders the speed and experience to close more loans, delight borrowers, and compete directly with non-bank lenders.

The platform transforming how financial institutions lend.

Coviance is a lending experience platform built specifically for home equity and HELOC lending.

Our Fast Track solution accelerates your path from application to funding — giving community lenders the speed, simplicity, and borrower experience needed to compete against rising ‘non-bank’ lenders.

Coviance customers experience measurable growth without adding complexity or a change in policy.

Speed at Every Stage of the Loan

Fast Track includes three applications that work together to accelerate every step of the home equity journey from first click to funded loan.

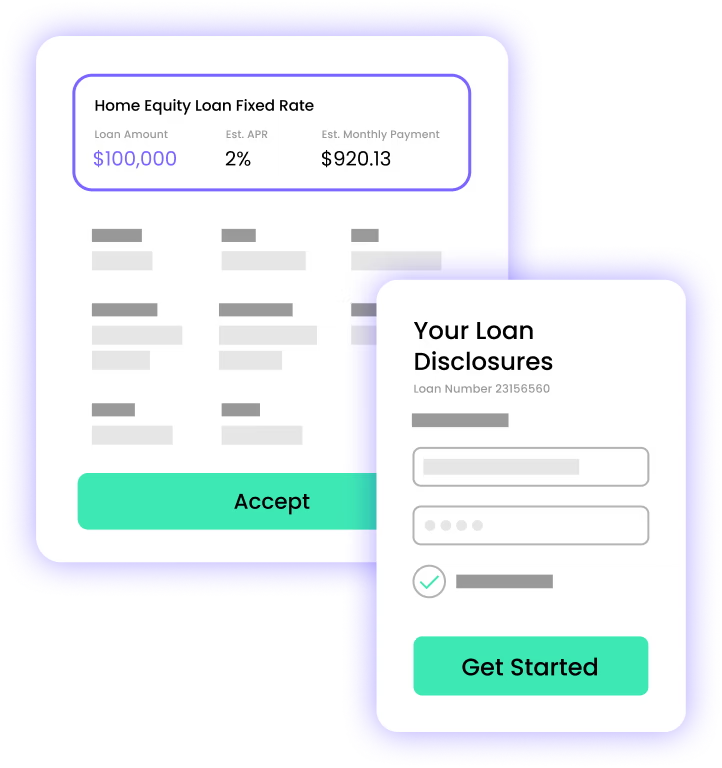

Borrower Engage

Borrowers move quickly to a conditional offer in minutes, with a streamlined application and embedded collaboration that keep them engaged throughout the process.

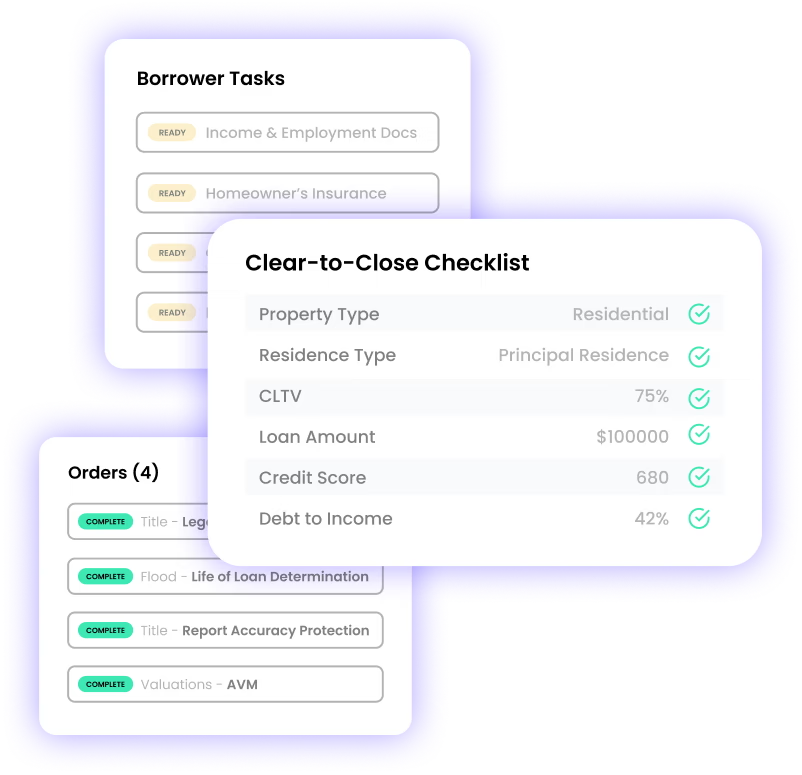

Lender Intelligence

Simplify and accelerate loan approvals with our decision guidance engine, making simple loans fast and compliant.

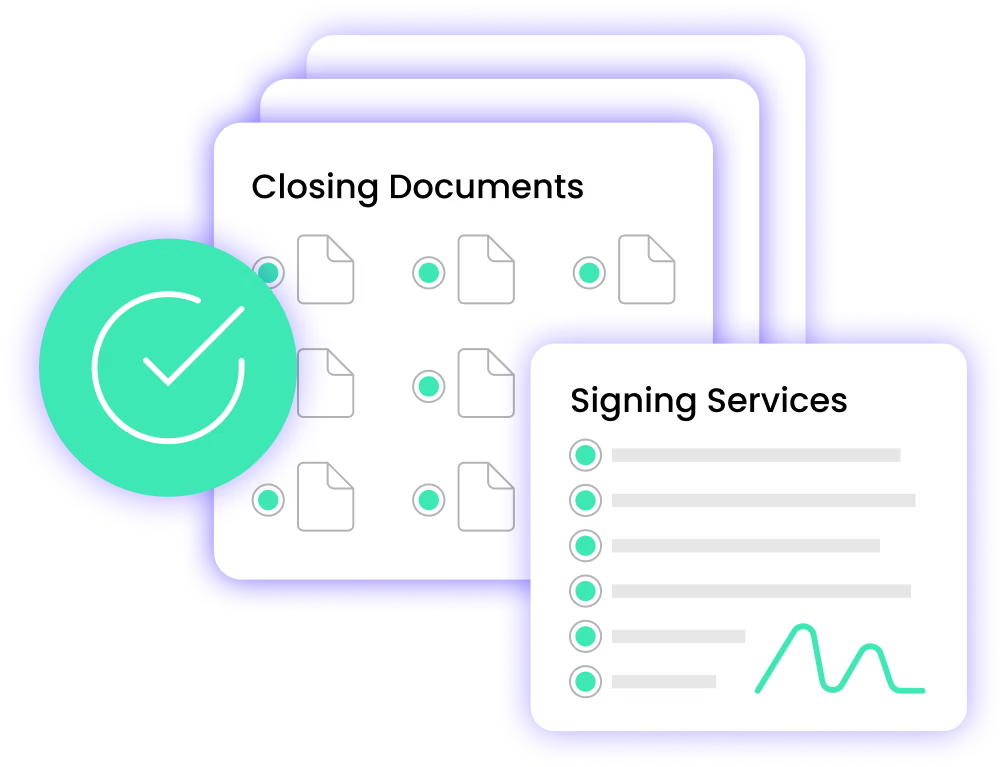

Quick Close

Streamline the final stages of the lending cycle and give lenders the platform they need to close & fund in under a week.*

We love our customers like you love yours

Don’t take it from us. Hear from our customers about the power of Coviance.

Events & Webinars

Explore our upcoming events & webinars and experience lending automation firsthand.

Consumer & Residential Mortgage Lending School

Industry insights for all things lending

Check out our library of insights and best practices—all designed to help you grow.

Frequently Asked Questions

Can't find what you're looking for?

Yes, home equity loans can be refinanced under certain circumstances. This can be beneficial if you want to secure a lower interest rate, access a larger loan amount, or consolidate debt. However, refinancing typically involves closing costs such as loan origination fees, appraisal fees, and title search insurance fees.

Home equity loans are a type of loan secured by a borrower's home. The borrower receives a lump sum of cash based on the appraised value of their home minus their existing mortgage balance (equity). They repay the loan with interest over a fixed term.

Coviance's cloud-based platform offers several benefits over traditional, on-premise solutions:

- Scalability: Coviance easily scales to meet your growing loan volume without additional hardware investment.

- Accessibility: Authorized users can access the platform securely from any internet-connected device, improving flexibility and remote work capabilities.

- Reduced IT Costs: Our cloud-based deployment model eliminates the need for expensive hardware and software maintenance, minimizing IT burden.

- Automatic Updates: Coviance handles software updates automatically, ensuring you always have access to the latest features and security patches.

- Enhanced Security: We offer robust security measures to protect sensitive borrower and loan data.

By leveraging cloud technology, Coviance offers a cost-effective, scalable solution for automating your home equity lending process.

Home equity loans typically offer lower interest rates than credit cards or other unsecured loans, saving borrowers a significant amount of money on interest charges over the life of the pre-consolidated loans. Additionally, consolidating debt into a single monthly payment can simplify budgeting and make it easier to stay on track with repayments.

Home equity loans offer a valuable service to your customers, allowing them to access funds for important expenses like home renovations, education, or debt consolidation. By offering home equity loans, your organization can deepen relationships with existing customers, attract new customers, and generate additional non-interest income.